June 13, 2025

Strategy

Base-150 Trading Strategy

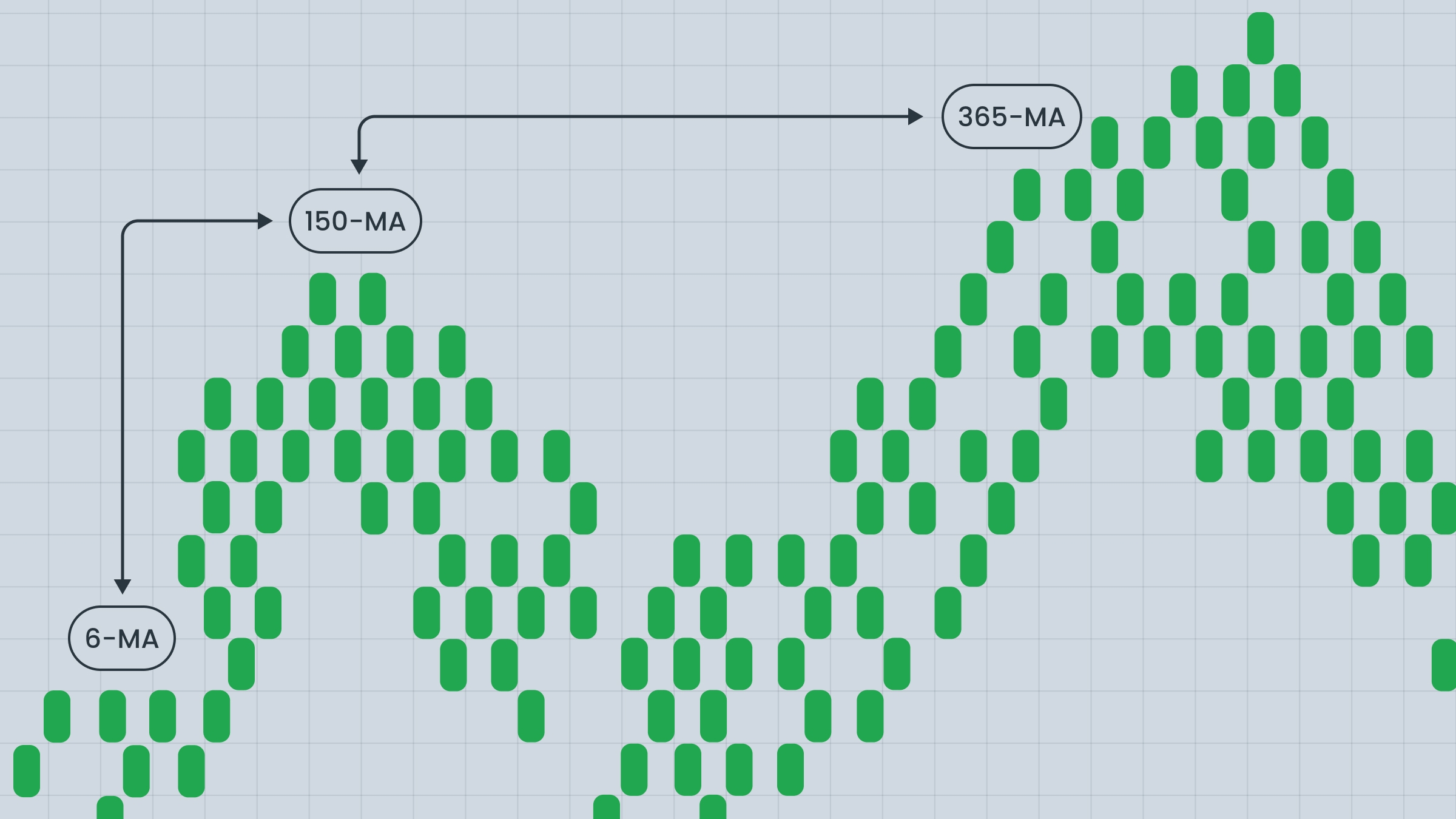

This is a trend-trading strategy. It enables a trader to determine trends and choose entry points. Long-term Moving Averages are used to confirm the general market direction, and short-term ones are used to indicate where to open a position.

Tools

For trend identification

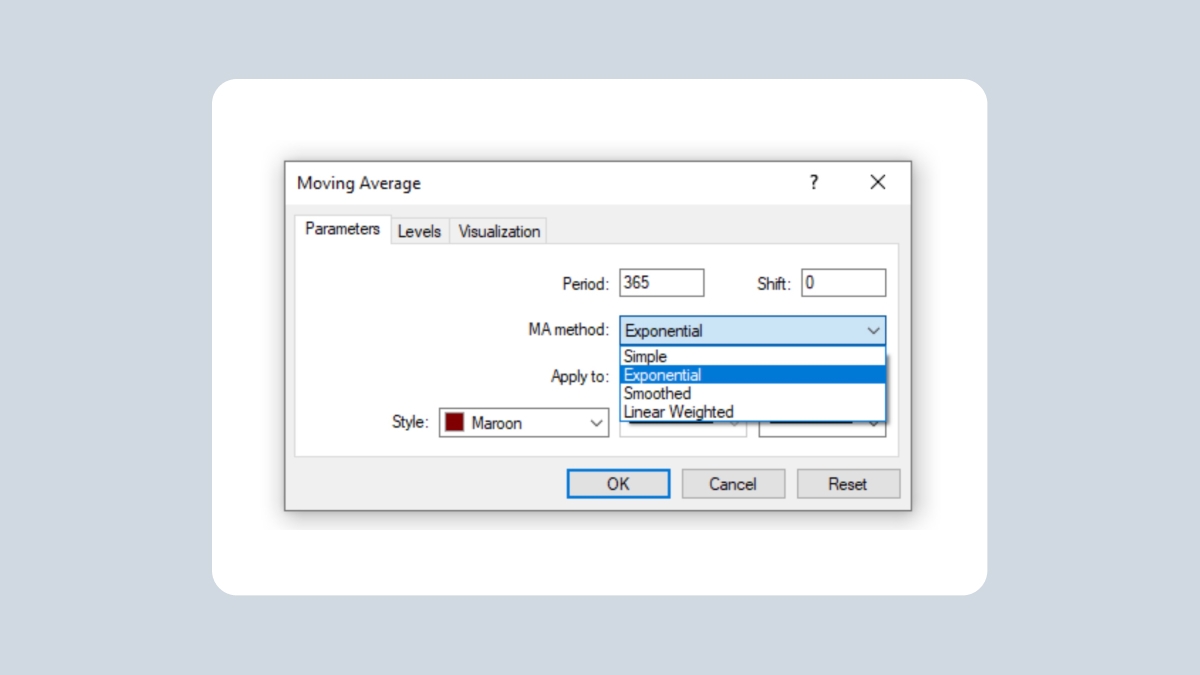

Long-term Moving Averages: 365-period and 150-period, both exponential.

For entry point identification

Short-term Moving Averages: 26-period and 6-period, both exponential.

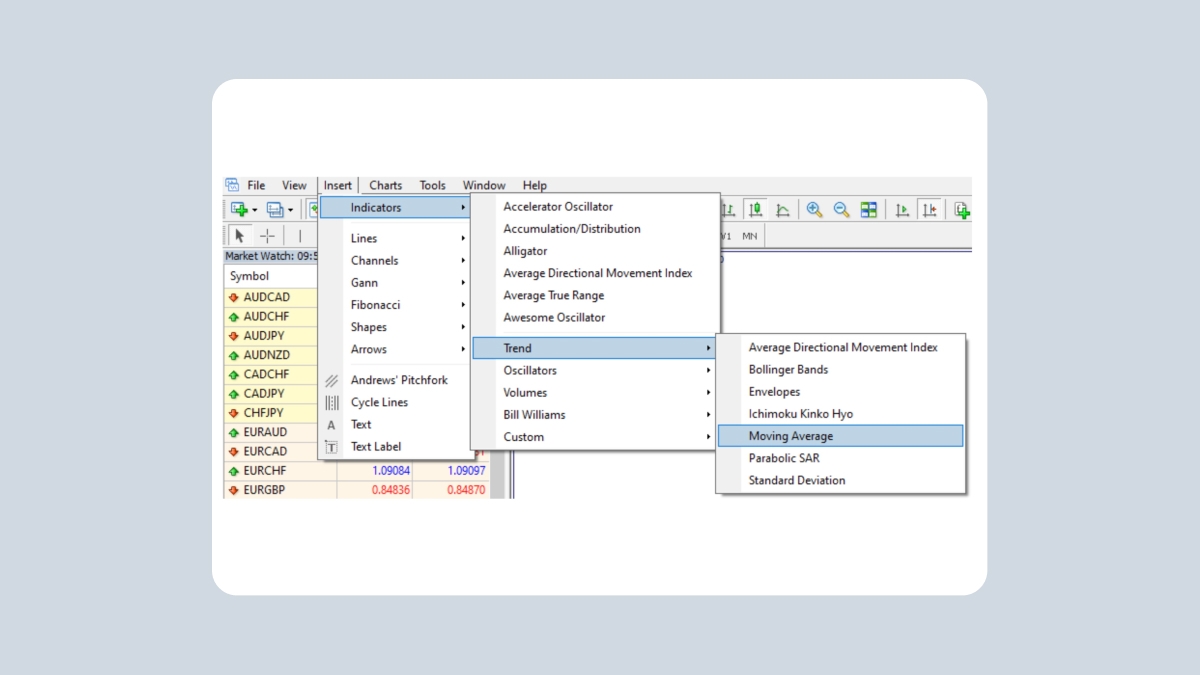

Setting the Moving Averages

Below you will see where to choose the Moving Average indicators in the MetaTrader menu.

Right-click on the Moving Average line and choose the Properties menu to set the required exponential method, as shown below.

Timeframes

Daily, H4 and H1 are most convenient for this strategy.

Trade items

You can trade any currency, stock or commodity using this strategy. However, to make regular profits, it’s more efficient to trade currency pairs or other items that show more regular price movement patterns. We suggest EURUSD, GBPUSD, GBPCHF, and USDJPY for this strategy.

Steps

Identifying the trend

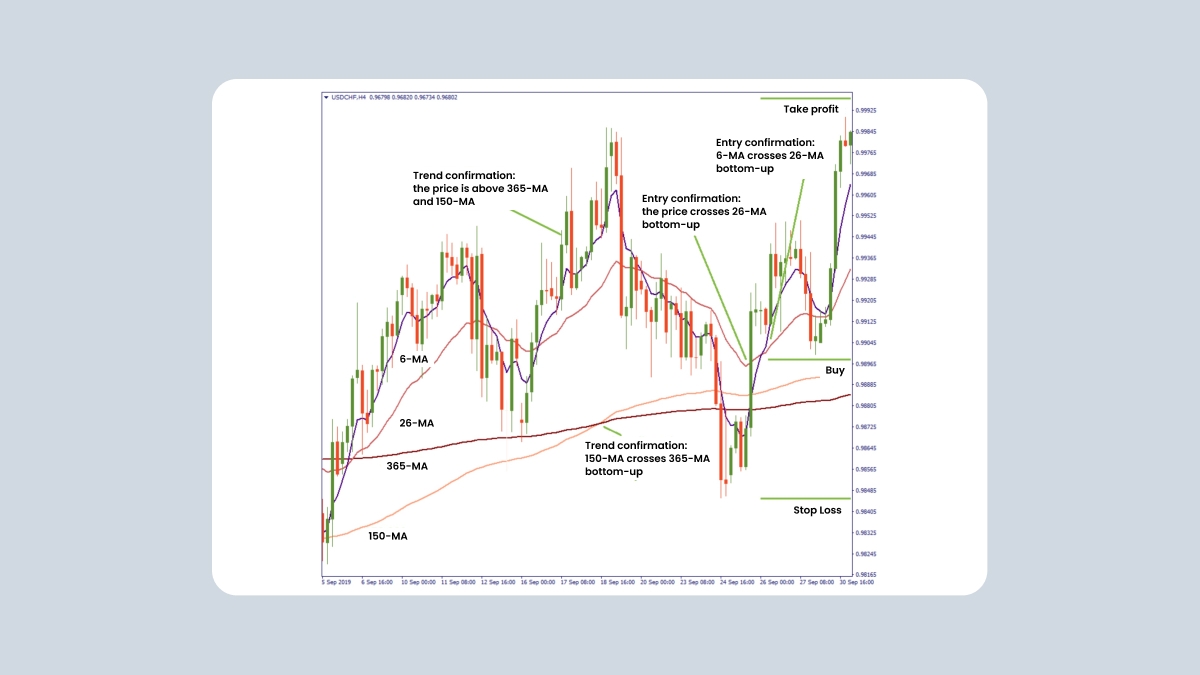

Remember the trend-trading rule: buy on the rising market, sell on the decline. So, the first thing you need to understand is if the market is rising or falling. To do that, plot 365-period and 150-period Moving Averages on the chart.

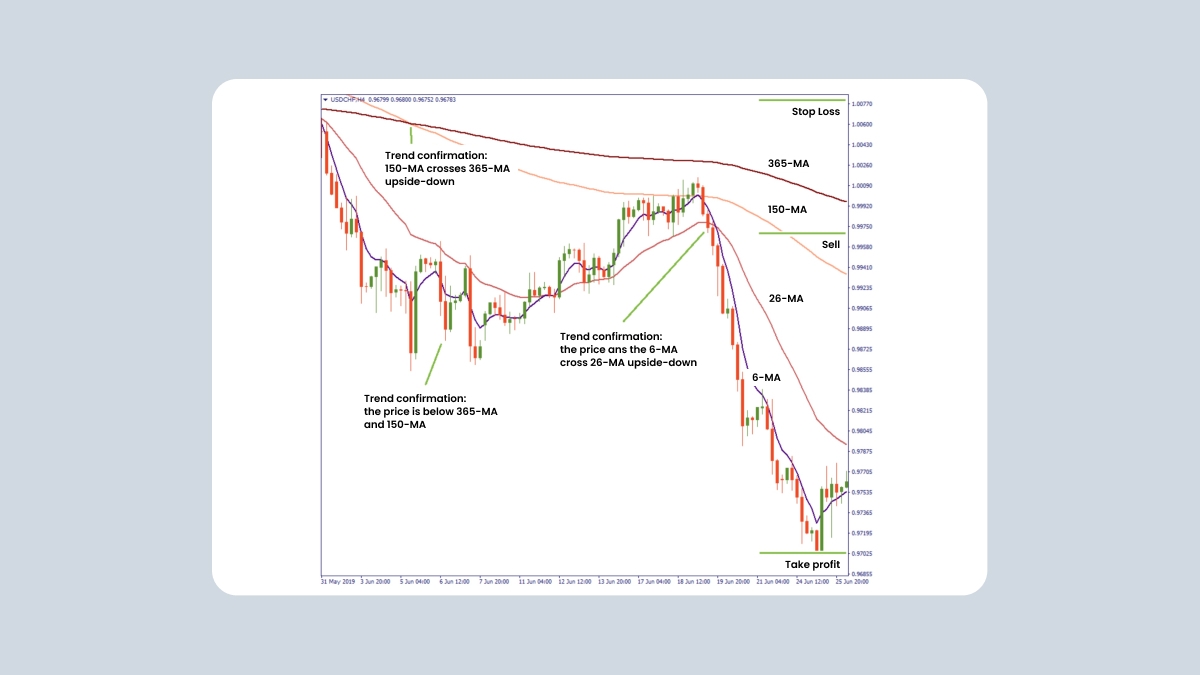

If you see that prices are above the 365- and 150-MAs (or the 150-MA crosses the 365-MA bottom-up), that is a rising trend. Hence, you will buy. Otherwise, if prices are moving below both long-term MAs (or the 150-MA crossed the 365-MA upside-down), that’s a downtrend. In that case, you will sell.

Identifying an entry point

Now, find an entry point. To do that, plot 26-period and 6-period MAs on the chart.

Uptrend/buying

In an uptrend, wait for the price (or the 6-MA) to cross the 26-MA bottom-up – that will be your signal to open long positions.

Downtrend/selling

In a downtrend, when you see the price (or the 6-MA) crossing the 26-MA upside-down, you sell.

Stop-loss

We recommend setting the stop-loss above the 365-MA for the sell trade, and below the 365-MA for the buy trade.

Summary

According to various media, this strategy enabled a group of traders to gain significant profits on 80 deals in a row. While that may be the case (we cannot deny the possibility of an effective trading strategy in use), we do not advise you to get obsessed with any single strategy to see if you actually hit 80 or 100 or any other number of successful deals based on this approach.

Sober risk-management and expectations from daily trading are always the best practice. See if this strategy works for you, and take some time to reality-check it. If it is successful, well done; proceed with caution. If not, continue learning and try using other strategies.

Open an FBS account

By registering, you accept FBS Customer Agreement conditions and FBS Privacy Policy and assume all risks inherent with trading operations on the world financial markets.