Low risk

They are much safer than investing in stocks, bonds, or mutual funds that invest in those kinds of assets. They are designed to be this way and regulated to stay that way.

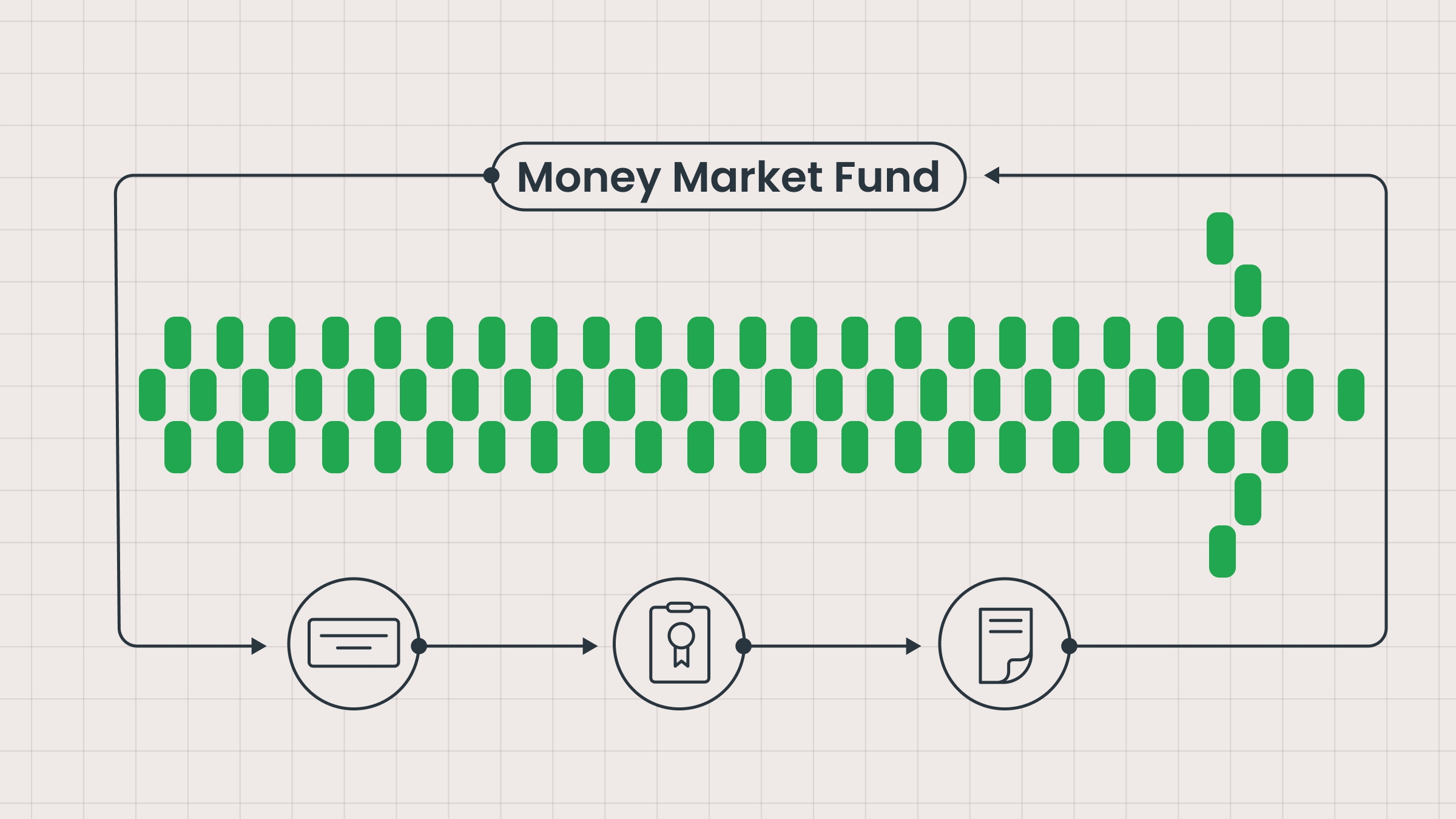

Operational ease

They are easy to invest in: you simply buy or sell shares of the fund, and the rest is managed on your behalf. You can achieve diversification with a single share. It would be more complicated and time-consuming to do so on your own because you would have to continuously reinvest your money after reaching short-term maturity. With MMFs, your money remains invested as long as you own the shares.

Higher yield

Thanks to the fund pooling money, you can have access to several securities using less capital. Your return is simply proportional to the amount you invest. Since funds are actively managed and invest in short-term positions, they tend to generate earnings that are greater than those of a deposit or savings account. Putting your cash in an MMF is therefore kind of like holding your cash on steroids.

Liquidity

Unlike traditional interest-earning bank accounts, MMFs don’t have any lock-up periods, which means they won’t impose penalties if you take your money back before a certain date. You just redeem your initial investment with whatever interest the fund has generated in that time. This liquidity makes MMFs more attractive and grants investors greater freedom.

Limitations of money market funds

While MMFs have their advantages, they also have their own set of limitations.

No guarantee or insurance

There is absolutely no guarantee that the MMF will generate any interest for you, and you run the risk of losing your investment if the fund goes bankrupt. Your money isn’t protected like it would be in an FDIC-insured deposit or savings account. Once again, higher rewards come with higher risk.

Low returns

While MMFs will generate more money than holding cash or putting it in a savings account, their returns are still very low compared to other types of mutual funds or investments. If interest rates are lowered, the funds will also generate lower returns. Some funds may be better equipped to make up for changes in interest rates than others.

Low interest rate

If interest rates are lower than inflation, keeping your money in the fund equates to losing money. The amount you receive in interest is too low to keep up with inflation, so your purchasing power goes down. You could say that any interest earned is better than no interest earned, but you can also put your money to work elsewhere. Funds mostly tend to outperform inflation, though, and even when inflation rises too high, rates are adjusted and inflation eventually comes back down, so it doesn’t last too long.

Credit risk

If a bank borrowing money from the fund goes bankrupt, it can’t pay it back to the fund, and investors can lose money. MMFs tend to invest only in the biggest and most established and reliable banks, so while it is still a possibility, losing money like this is very rare.

Market stress

In very rare cases, when the market is under a great amount of stress, the NAV price can “break the buck” and drop below $1. MMFs are highly regulated to avoid this, but it remains a rare possibility. During a financial crisis, funds can also impose fees to limit redemptions. If things get really bad, funds can also block investors from redeeming their money altogether until things settle down. This is called a “redemption gate.”

Summing up

Always do your research and read up on the fund you want to invest in, because some funds may be better equipped to deal with market volatility, geopolitical events, lowered interest rates, and general uncertainty. MMFs will have an online prospectus on their website that details their strategy, assets, performance, fees, and other important information, allowing you to make informed decisions. You can also find this information on the SEC’s website.