Here are five ways to diversify your portfolio:

Spread across different asset classes. Don’t put all your money in one type of asset; combine stocks for growth, bonds for stability, and cash for emergencies.

Spread across sectors. Don’t invest only in tech or only in real estate: buy some in consumer goods (like Procter & Gamble), finance (like JPMorgan), and energy (like ExxonMobil).

Use ETFs and mutual funds. These instruments follow an index, so it’s a great opportunity to gain exposure to many companies at once with little effort. For example, an S&P 500 ETF gives you shares in 500 top U.S. companies.

Consider geographical diversification. Invest in companies from different countries (U.S. stocks + European stocks + emerging markets).

Rebalance your portfolio regularly. Some assets may outweigh others as your investments grow. If stocks rise and now make up 80% of your portfolio (and your initial target was 65%), sell some and buy more bonds or cash assets to restore balance.

3. The 70/30 rule (inspired by Warren Buffett)

A popular guideline for beginners is the 70/30 rule. It applies to the general distribution of your income. Put aside 70% of your income for expenses and invest 30% (and/or use it to pay off debt). If we’re talking about pure investing, put 70% of your portfolio in stocks for growth and 30% in bonds or other safer assets for stability. This combination balances risk and reward, allowing for long-term growth while keeping potential losses in check.

4. Invest in low-cost index funds

An index fund is a type of mutual fund or ETF that tracks a specific market index (like the S&P 500). It passively mirrors the index, so you don’t have to actively choose stocks.

Index funds and ETFs that track major stock market indeces are fantastic for beginners. They offer broad market exposure with lower fees, making them a great choice. They provide instant diversification, require little management, and have a solid track record of delivering good long-term returns. Look into these index funds:

Vanguard Total Stock Market ETF (VTI) gets you U.S. market exposure;

Schwab S&P 500 Index Fund (SWPPX) follows the stocks of 500 largest U.S. companies;

Fidelity ZERO Total Market Index Fund (FZROX) comes with no fees at all (a great option for a beginner);

Vanguard FTSE All-World ex-US ETF (VEU) exposes your portfolio to international markets.

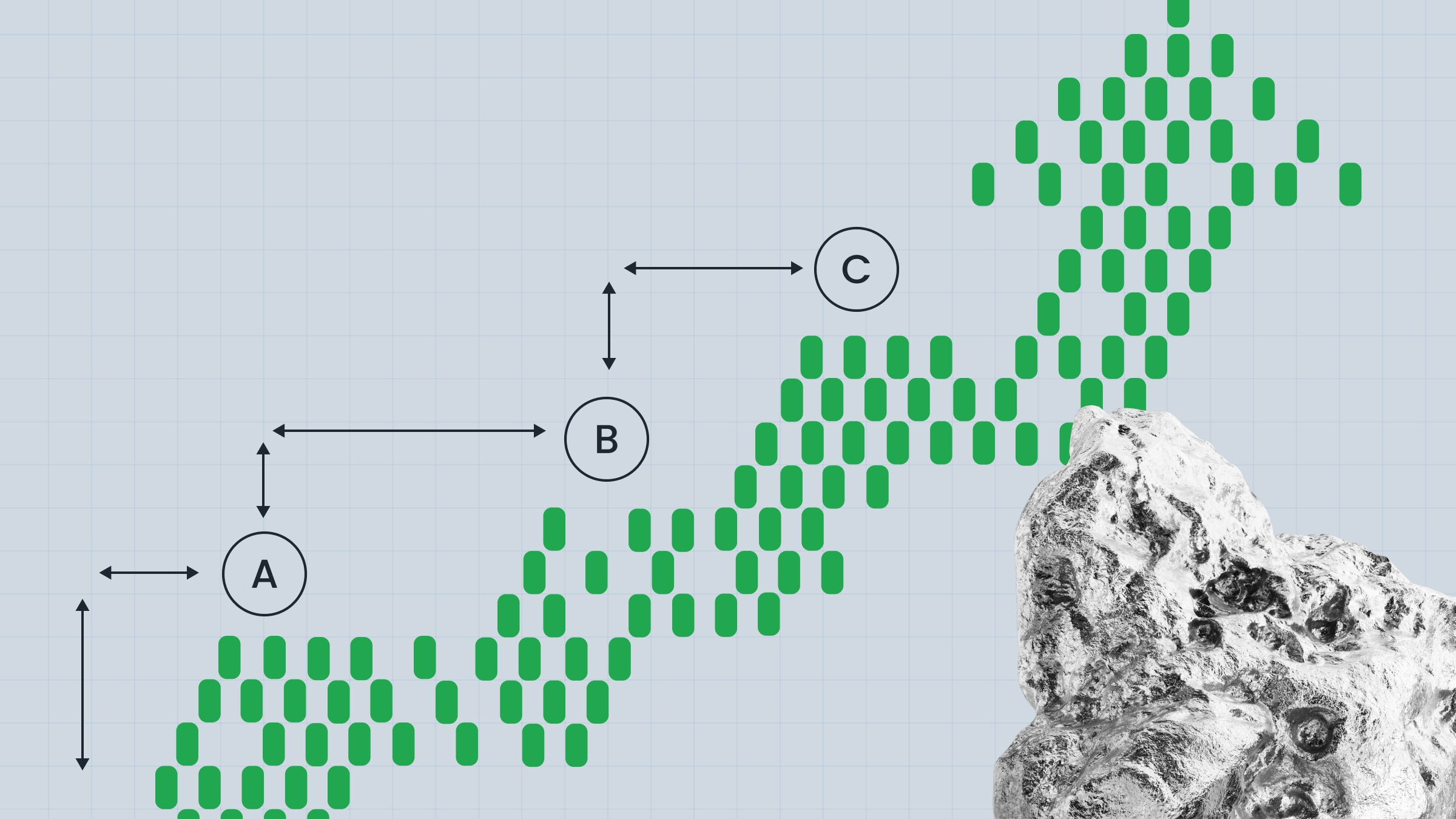

5. Dollar-cost averaging (DCA)

Dollar-cost averaging means investing a fixed amount of money at regular intervals, no matter what market conditions are. You buy more shares when prices are low and fewer when prices are high, which helps to lower your average cost over time per share and steady your investment’s growth. It helps:

reduce emotional investing, so you’re not trying to time the market;

spread out risk, so you don’t put all your eggs in one basket;

build discipline through regular investing habits.

6. Reinvesting dividends for compound growth

Dividends are payments that companies make to shareholders from their profits. They can be paid at different regular intervals. When you reinvest your dividends, you use those payouts to buy more shares instead of cashing out. This strategy uses the power of compounding, meaning your returns can generate even more returns over time. Many brokerage accounts offer automatic dividend reinvestment plans (DRIPs) to make this process a breeze.

For example, you invest $10 000 in a dividend-paying index fund that pays a 3% annual dividend and grows in value by 5% per year. Say your dividends are reinvested automatically: after 20 years you earn almost $8000 more. That’s the power of compounding!

Want to profit more? Practice investing with an FBS demo account!