The British Pound (GBP) is slightly weaker than the US Dollar (USD), down by about 0.2%, while the USD remains strong. According to Shaun Osborne, Chief FX Strategist at Scotiabank, the Pound is struggling to keep its gains despite positive news about wages and jobs in the UK.

Recent data showed that wages in the UK grew by 6.0% for the three months ending in December, which was better than expected. Additionally, more people found jobs than analysts had predicted. This has reduced expectations of interest rate cuts from the Bank of England (BoE), aligning with the BoE’s cautious approach to lowering rates.

Even though the Pound gained some strength last week, it struggled to surpass the 1.2610 level against the USD, a key resistance point. The Pound has been moving around the 1.26 mark for the past two days without making significant progress. If it drops below 1.2580, it could fall further to the 1.2525/30 range.

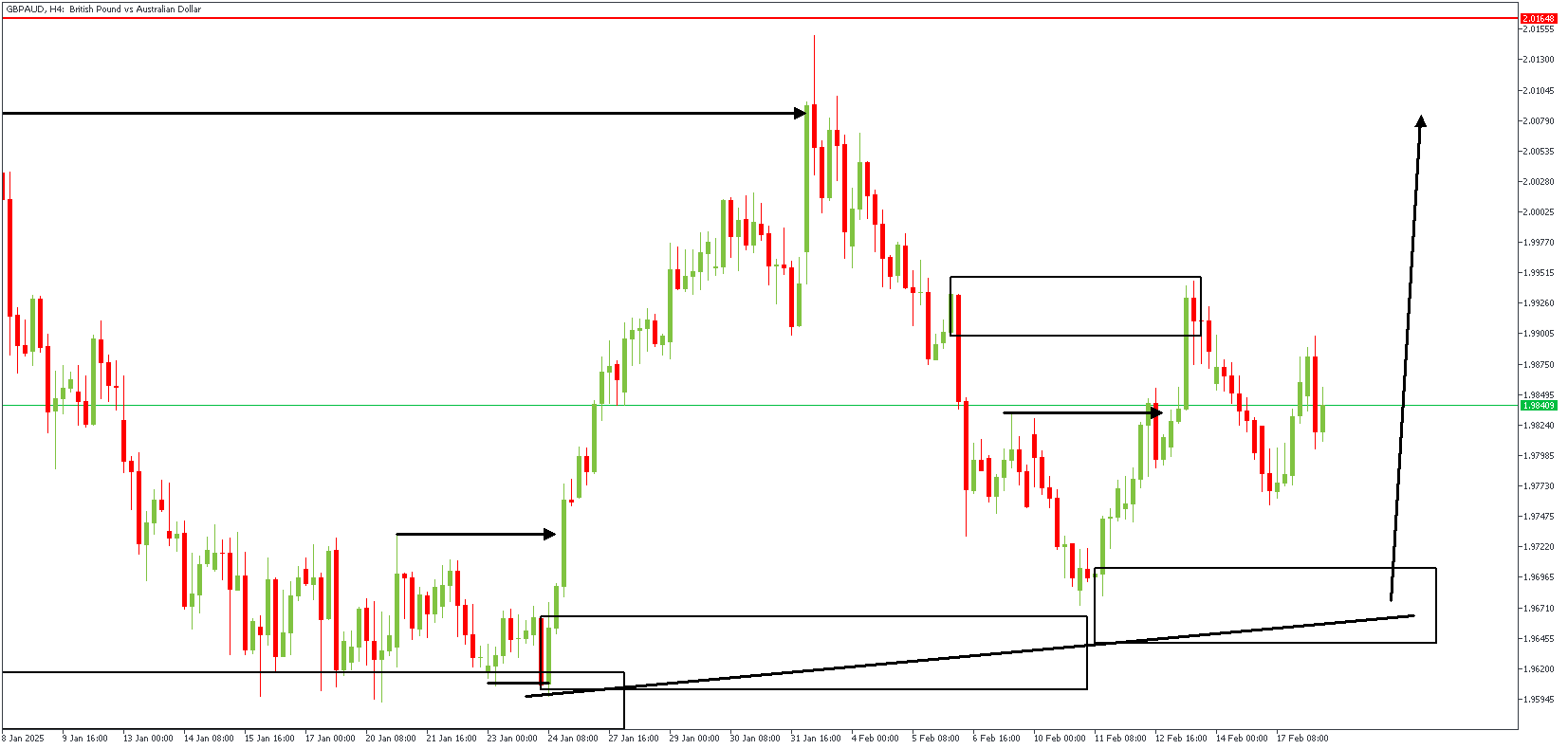

GBPAUD – H4 Timeframe

The 4-hour timeframe chart of GBPAUD shows the price reacting off the confluence area of a trendline support and a drop-base-rally demand zone. The initial momentum has declined, allowing for a bearish retracement and a possible retest of the trendline support.

GBPAUD – H2 Timeframe

.png)

The 2-hour timeframe chart of GBPAUD further clarifies the original bullish sentiment on the higher timeframe. It presents an SBR (Sweep Break Retest) pattern with the demand zone lying around the 88% Fibonacci retracement level. The confluence from the trendline support confirms a bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 2.00705

Invalidation: 1.95451

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.