The Pound Sterling (GBP) rose 0.37% to 1.2669 after rebounding from a two-day low of 1.2605, as the US Dollar weakened due to falling US Treasury yields. Market sentiment turned negative following US President Trump's renewed tariff threats on Canadian and Mexican goods. Weak US economic data also weighed on the Dollar, with the 10-year Treasury yield dropping 10 basis points to 4.30%. US home prices rose 4.5% year-over-year in December, slightly higher than November's 4.3%. The Confederation of British Industry in the UK reported that retailers plan to cut investments due to weak spending and high prices. A Reuters poll suggests the Bank of England (BoE) will likely keep rates steady at 4.50% in March, possibly cutting to 4.25% in Q2. Traders now await comments from BoE's chief economist, Huw Pill.

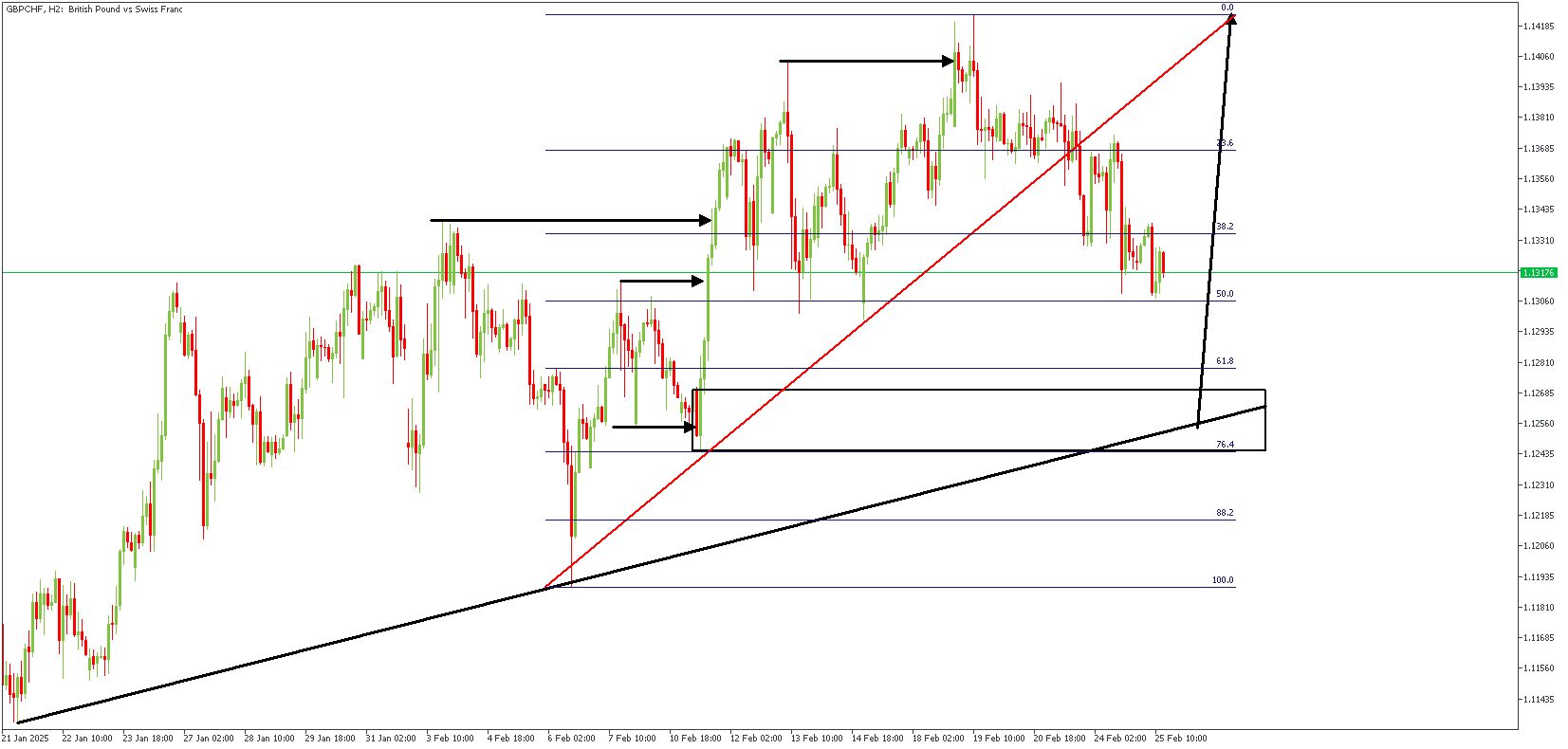

GBPCHF – H4 Timeframe

.png)

The highlighted demand zone on GBPCHF's 4-hour timeframe chart is the result of a bullish SBR pattern, with confluences from the 61% Fibonacci retracement level, 200-period moving average support, and trendline support. An FVG near the demand area lends further credence to the bullish sentiment.

GBPCHF – H3 Timeframe

The 3-hour timeframe chart of GBPCHF shows the SBR pattern in more detail, with the induced low visibly retracing before filling up the FVG area. The reaction from the confluence of the demand zone, the trendline support, and the 61% Fibonacci retracement level is expected to push prices to create a new higher high.

Analyst's Expectations:

Direction: Bullish

Target- 1.14218

Invalidation- 1.12162

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.