Summary

- Key Resistance in Sight:

- USDCAD is approaching a critical resistance level near 1.3840, aligned with the 50-day EMA. This zone has historically acted as a pivot point—a decisive break above could unleash further bullish momentum toward recent highs.

- Support Levels to Watch:

- Immediate support is seen at 1.3760. A drop below this level could signal a bearish reversal, potentially targeting the following downside zones near 1.3700 and 1.3665.

- Momentum Signals Flash Warning:

- The RSI is nearing overbought territory, suggesting the pair may be overextended in the short term. While not a reversal signal, it calls for caution and increased attention to reversal patterns or momentum fades.

Fundamental Drivers

U.S. Dollar Strength Holds Firm

- The greenback continues to gain ground due to strong consumer confidence data and the Fed's hawkish stance on monetary policy. These tailwinds are providing critical support for the USD.

Canadian Dollar Faces Mixed Signals

- The loonie has recovered modestly from recent lows, but a sluggish domestic economy and waning effects of previous tariff policies cap its upside. Soft data could undermine further gains.

Short-Term Outlook

USDCAD is at an inflection point. A clean break above 1.3840 could trigger a rally toward 1.3900+, especially if U.S. data remains supportive. However, the overbought RSI and strong resistance cluster suggest that bulls may face exhaustion before pushing higher.

Watch for U.S. GDP, Canadian inflation data, and Fed/BoC policy signals to guide the next leg. Traders should prepare for volatility as the pair flirts with a major breakout—or a rejection.

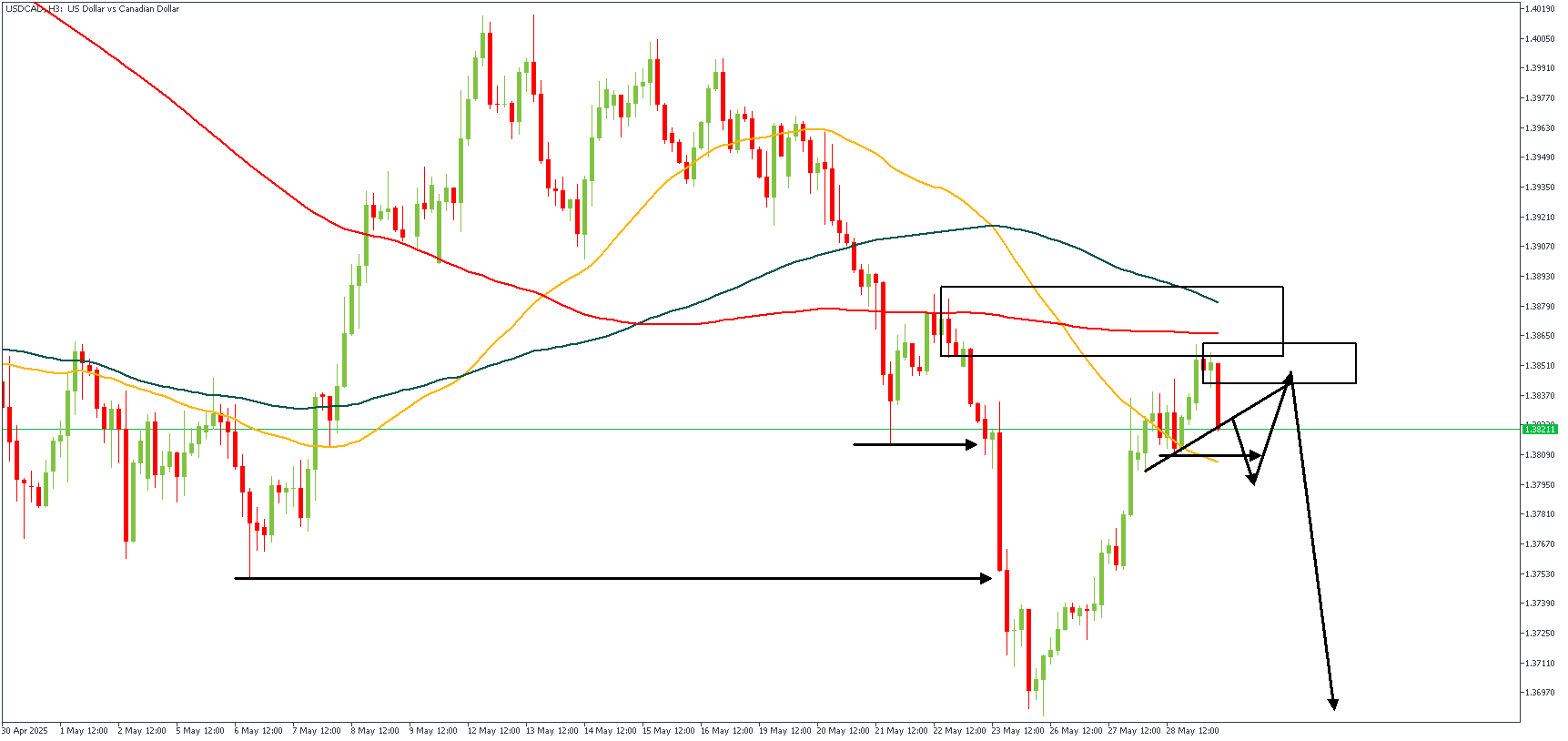

USDCAD – H3 Timeframe

The bearish break of structure on the 3-hour timeframe chart of USDCAD created a supply zone that overlapped the 100 and 200-period moving averages. The moving averages serve as a form of resistance and align perfectly with the bearish narrative.

Analyst's Expectations:

Direction: Bearish

Target- 1.37091

Invalidation- 1.38956

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.