EURUSD presents enticing opportunities for all traders—keep watching!

The EURUSD pair, often referred to by traders as the "Fiber," is the most traded currency pair in the Forex market. It reflects the Euro's relative strength against the US Dollar, two of the world's most significant currencies. The US Dollar's value is heavily influenced by economic indicators such as GDP growth, employment data, and Federal Reserve monetary policy decisions. On the other hand, the Euro is impacted by economic developments across the Eurozone, particularly Germany and France, as well as by the European Central Bank's policy actions.

US gross domestic product (GDP) QoQ, Aug 29, 14:30 (GMT+2)

The US economy is currently displaying resilience with solid growth, though concerns about inflation and a potential slowdown persist. The upcoming US GDP report is forecasted to show a steady growth rate of 2.8% for the quarter. If the actual GDP exceeds this forecast, indicating stronger-than-expected economic expansion, it could lead to a significant appreciation of the US Dollar. A stronger Dollar would likely push the EURUSD pair lower. Conversely, if the GDP figure comes below expectations, suggesting that the US economy is slowing down, the Dollar could weaken. In this scenario, the EURUSD pair might rise as the market anticipates a more dovish stance from the Federal Reserve.

Last time, US GDP came in below expectations, which led to a noticeable rise in EURUSD during the day!

Eurozone consumer price index (CPI) YoY, Aug 30, 11:00 (GMT+2)

The Eurozone CPI is forecasted to remain at 2.6%, reflecting stable regional inflation. If the CPI comes in higher than expected, it would signal rising inflationary pressures within the Eurozone. This could lead to speculation that the European Central Bank will keep monetary policy at current levels. This move would likely strengthen the Euro, driving the EURUSD pair higher. On the other hand, if the CPI is lower than forecasted, it could indicate that inflationary pressures are weaker than anticipated. This might prompt the ECB to maintain or even loosen its accommodative monetary policies, weakening the Euro, and, as a result, the EURUSD pair could decline.

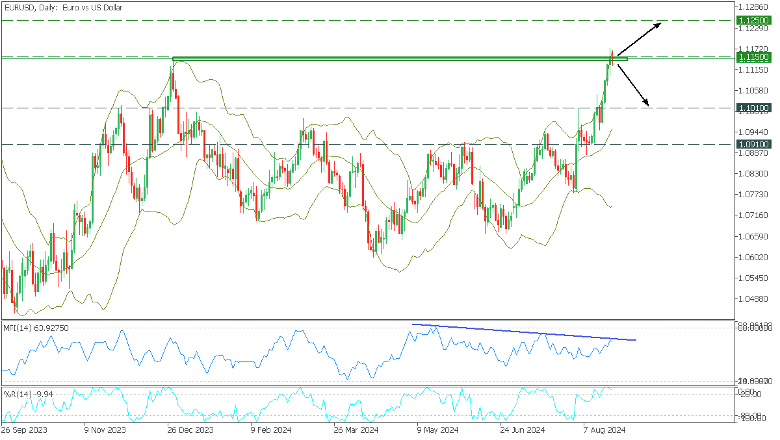

In the Daily timeframe, EURUSD, in a long-term bullish trend, reached a critical resistance level, testing the upper Bollinger line. Despite the solid bullish sentiment, a divergence has formed on the MFI, and the %R indicates overbought.

If the price breaks above 1.1150 resistance, the target will be 1.1250, which is last year's high;

A rebound from resistance will drop EURUSD to support at 1.1010;